The Best Guide To 2021 Medicare Supplement Plans - Health New England

You will need to pay the regular monthly Medicare Part B premium. In addition, you will need to pay a premium to the Medigap insurer. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is immediately renewed each year. Your protection will continue every year as long as you pay your premium.

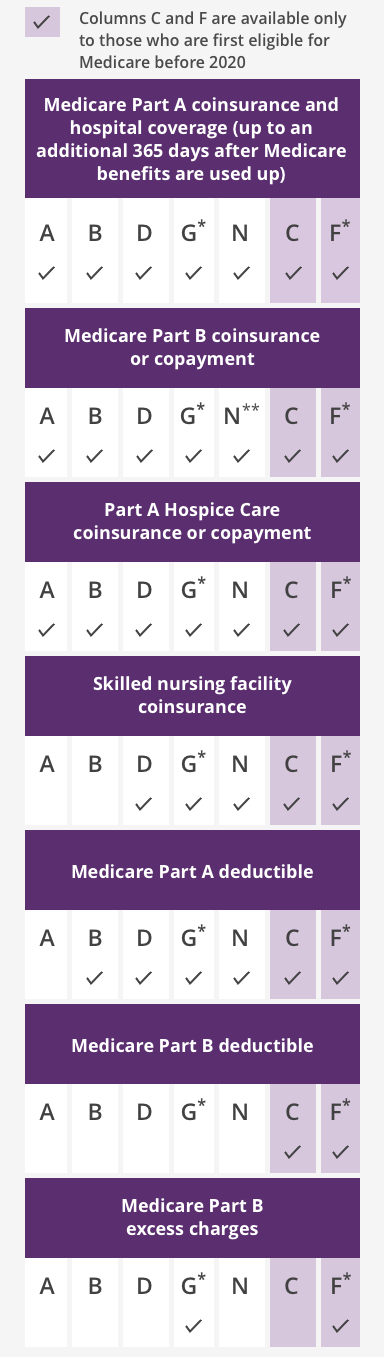

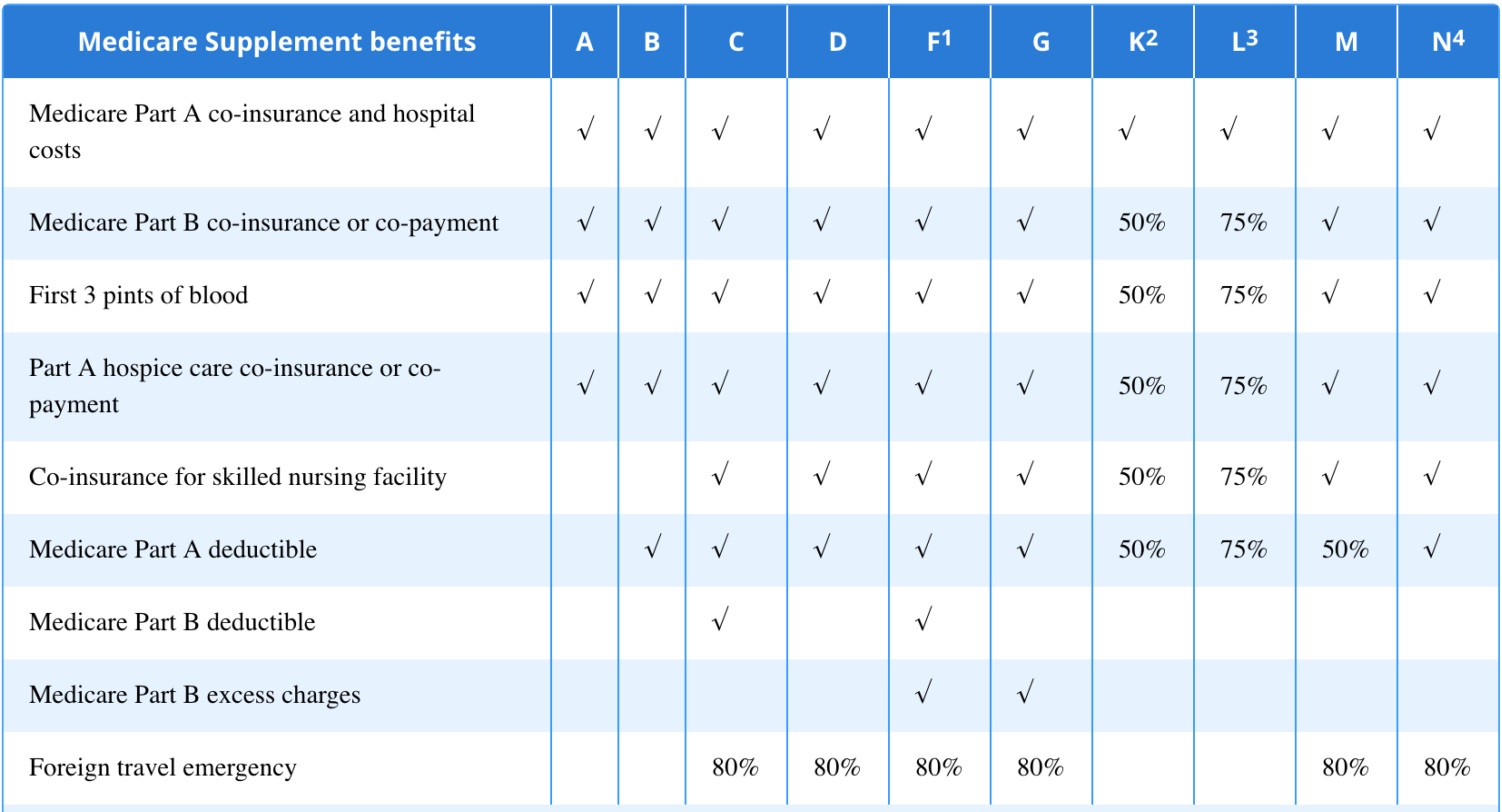

Insurance provider can just sell you a "standardized" Medigap policy. Medigap policies need to follow Federal and state laws. These laws protect you. The front of a Medigap policy should plainly recognize it as "Medicare Supplement Insurance."It's important to compare Medigap policies, since expenses can vary. The standardized Medigap policies that insurance coverage companies offer must provide the exact same benefits.

You and your partner must purchase separate Medigap policies. Your Medigap policy won't cover any health care costs for your spouse. Some Medigap policies also cover other additional advantages that aren't covered by Medicare. Keep Checking Back Here are guaranteed the right to buy a Medigap policy under specific situations. For more information on Medigap policies, you might call 1-800-633-4227 and ask for a free copy of the publication "Selecting a Medigap Policy: A Guide to Health Insurance for Individuals With Medicare." You might likewise call your State Health Insurance Coverage Assistance Program (SHIP) and your State Insurance Coverage Department.

Unknown Facts About Is a Medicare Supplement Plan Right for Me? - Excellus

The publication below sets forth circumstances under which the Secretary has actually figured out that providers may sell individual market medical insurance policies to specific Medicare beneficiaries under age 65 who lose state high risk swimming pool protection. As this bulletin discusses, for sales to these people, HHS will not implement the anti-duplication arrangements of section 1882(d)( 3 )(A) of the Social Security Act (the Act) from January 10, 2014 to December 31, 2015.

Join our 6-Day Medicare Mini Course We'll send you 6 e-mail lessons with s